Some companies may not need to look to guidance beyond whats available in IAS 38 to determine whether these criteria are met and there is no requirement to do so. Phases of Computer Software Development for Capitalizable Software Operating software either purchased outright or developed internally with a cost in excess of 100000 as determined by these guidelines shall be capitalized when placed in service.

Capitalize Software Development Costs Wall Street Prep

Capitalize Software Development Costs Wall Street Prep

In accounting software capitalization is the process of recognizing in-house software as fixed assets.

Software development capitalization. The application development ie. Everyones going low code but building apps with no code is faster and more effective. The finance department determines that 40 of project expenses can be capitalized over a five-year period which results in 6MM OpEx.

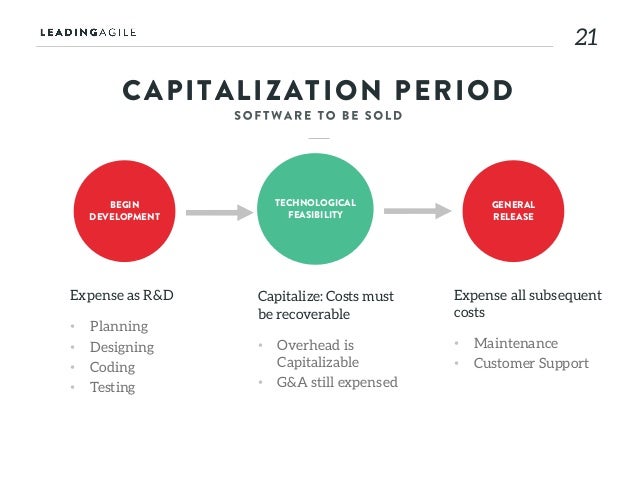

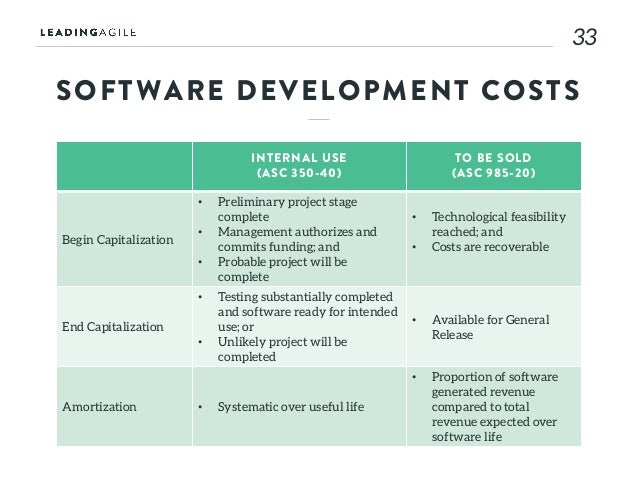

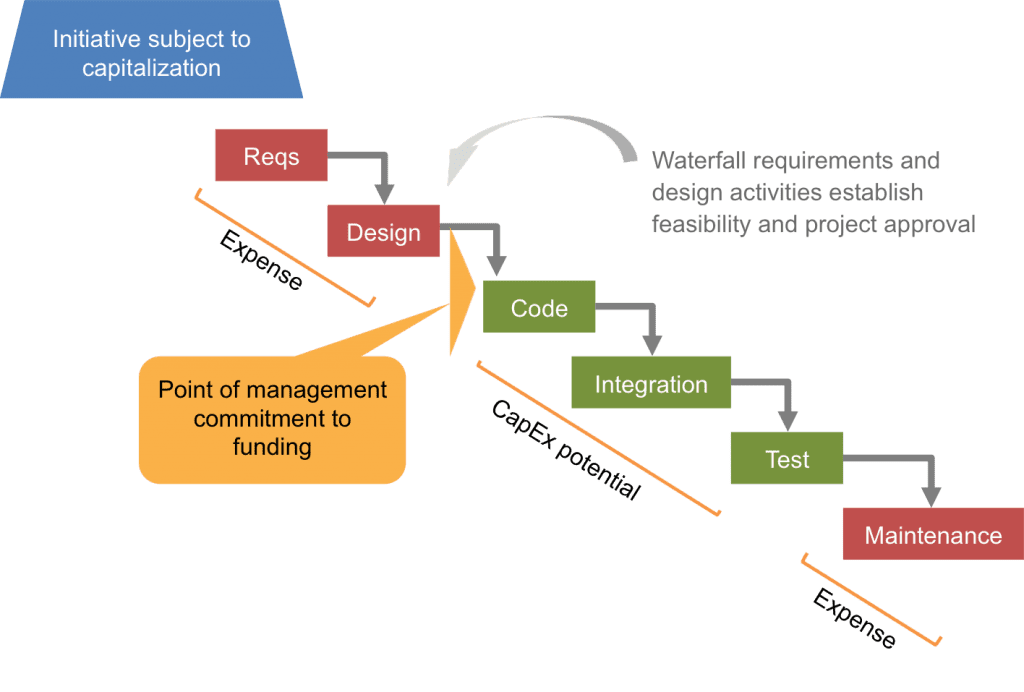

Coding stage for software intended for a companys internal use. What is software capitalization. The stage when technological feasibility is achieved for software that will be sold or marketed to the public.

Everyones going low code but building apps with no code is faster and more effective. Capitalization of software doesnt include software that is an integral part of property plant and equipment. Hence development costs associated with internally-developed software can be capitalized under IAS 38 if the criteria for capitalization are met.

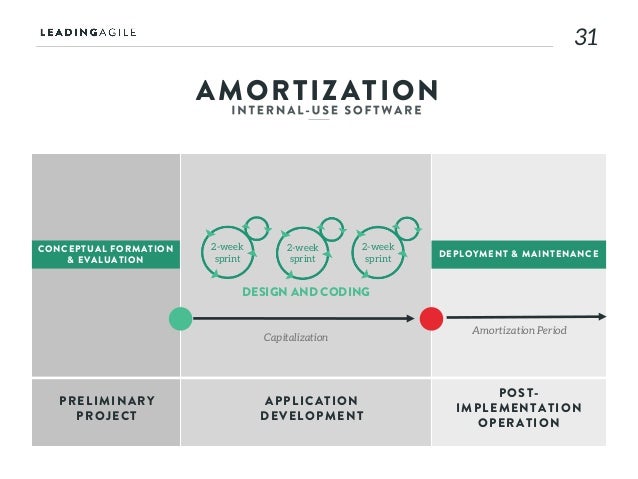

The literature says that expenses should be expensed as incurred in phases 1 and 3 but in the actual development of the new software functionality during phase 2 expenses should be capitalized. Under the internal-use software rules development costs generally can be capitalized after the end of. 10 section 38.

Begin capitalizing costs once the preliminary tasks are completed management has committed to fund the project and you can reasonably expect that the software will be completed and used as intended. Ad Simplify how work gets done with Pegas smart scalable cost-effective low-code platform. The costs you should capitalize are those that are directly related to the development deployment and testing of the software.

These rules commonly are referred to as the software capitalization rules for internal-use software. Then accountants can amortize these costs over time. It is important to note that the threshold for capitalization is lower for internal-use software.

ASC 730 Research and Development Applies to costs incurred to internally develop. Software is considered to be for internal use when it has been acquired or developed only for the internal needs of a business. Coding stage for software intended for a companys internal use.

The application development ie. Broadly speaking there are two stages of software development in which a company can capitalize software development costs. Ad Simplify how work gets done with Pegas smart scalable cost-effective low-code platform.

Accountants accomplish this by recording software costs on the balance sheet as capital expenses. The Short Answer is Yes. The rules depend on whether the developed software will be used internally or sold externally.

When new software is purchased and developed for specific use by the University the following phases generally occur. Published March 29 2019 Capitalization of Software Development Costs for SaaS Companies and Others that Develop Software When developing software for customers companies face the challenging question of which costs should be expensed. Capitalize expenses incurred in the application development stage which is the project stage that includes the design of the development process coding hardware installation and.

A project spends 10 million on software development. Now analogize this to a company investing in machinery for production of its primary goods. Also to know is are software development costs capitalized.

According to SFFAS No. We wont dive into the complicated specifics in this article. GAAP states that certain costs for both internal-use and external-use software should be capitalized.

Examples of situations where software is considered to be developed. As technology organizations shift to accommodate market pivots and competitive threats Agile practices often scale across software development and IT to. Capitalized software costs are costs such as programmer compensation software testing and other direct and indirect overhead costs that are capitalized on a companys balance sheet instead of being expensed as incurred.

Applies to software development costs for a software product that will either be sold or embedded in a product that will subsequently be sold leased or otherwise marketed. GAAP has rules for capitalization of software development costs. Software capitalization involves the recognition of internally-developed software as fixed assets.

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Pdf Capitalization Of Software Development Costs A Survey Of Accounting Practices In The Software Industry Semantic Scholar

Pdf Capitalization Of Software Development Costs A Survey Of Accounting Practices In The Software Industry Semantic Scholar

Capitalize Software Development Costs Wall Street Prep

Capitalize Software Development Costs Wall Street Prep

Software Capitalization And Agile The Solution

Software Capitalization And Agile The Solution

Software Cost Capitalization And Scrum Strm Alm Blog

Software Cost Capitalization And Scrum Strm Alm Blog

Capex And Opex Scaled Agile Framework

Capex And Opex Scaled Agile Framework

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Software Capitalization And Agile The Solution

Software Capitalization And Agile The Solution

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Accounting For External Use Software Development Costs In An Agile Environment Journal Of Accountancy

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Avoiding The Pitfalls Of Capitalizing Software In An Agile World

Capex And Opex Scaled Agile Framework

Capex And Opex Scaled Agile Framework

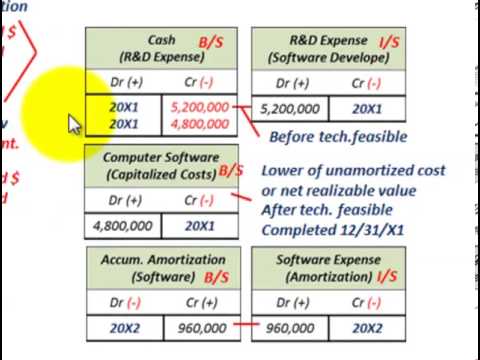

Intangible Assets Accounting Computer Software Capitalization Amortization R D Expense Youtube

Intangible Assets Accounting Computer Software Capitalization Amortization R D Expense Youtube

No comments:

Post a Comment